The Rise of Fintech: Everything You Need to Know about Digital TDC

In the ever-evolving world of technology, the financial industry has seen a remarkable transformation in recent years. The rise of financial technology, commonly known as fintech, has revolutionized the way we handle our finances. One significant aspect of fintech that has gained immense popularity is the use of digital TDCs (Tarjeta de Crédito, in Spanish), offering a convenient and efficient way to manage our money. In this article, we will explore the surge of fintech and delve into everything you need to know about TDCs in the digital realm.

Hook: Can you imagine a world where you can control your financial transactions with just a tap on your smartphone? Welcome to the exciting universe of digital TDCs, where convenience meets technology, and your wallet fits in the palm of your hand.

Heading 1: The Fintech Revolution: A Brief Overview

With the advent of the internet and the widespread use of smartphones, the financial industry has undergone substantial changes. Traditional banking practices have been disrupted, paving the way for innovative and user-friendly alternatives. Fintech, an umbrella term for technology-driven financial services, has emerged as a game-changer. These advancements have allowed consumers to access financial services in ways that were previously unimaginable.

Heading 2: Understanding TDCs in the Digital World

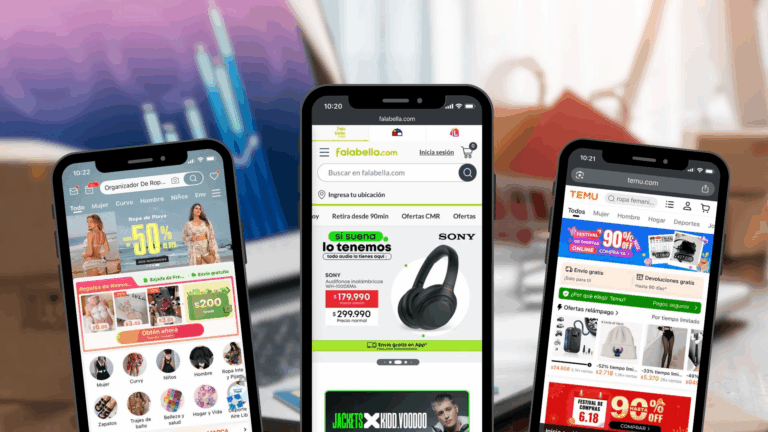

TDCs, or Tarjetas de Crédito, have long been a popular means of payment. However, in the digital age, traditional TDCs are being replaced by their digital counterparts. Digital TDCs function similarly to physical cards but offer added convenience and security. By using mobile applications or online platforms, users can apply for, manage, and use their TDCs remotely. This digital transformation has made financial transactions more efficient and has eliminated the need for physical cards.

Heading 3: The Benefits of Digital TDCs

1. Convenience: One of the primary advantages of digital TDCs is their convenience. With just a mobile phone and an internet connection, users can manage their finances anytime, anywhere. No more rifling through wallets or worrying about lost or stolen cards.

2. Enhanced Security: Digital TDCs employ advanced security features, such as encryption and biometric authentication, making them more secure than traditional cards. In the event of loss or theft, users can easily report and block their digital TDC, safeguarding their funds.

3. Streamlined Payments: Say goodbye to lengthy and cumbersome payment processes. Digital TDCs offer seamless and quick transactions, reducing the time spent standing in lines or waiting for funds to transfer.

4. Budgeting Assistance: Many digital TDC applications provide real-time spending notifications, helping users keep track of their expenses and budget effectively. This feature allows for better financial management and control.

Heading 4: FAQs about Digital TDCs

Q1: Can anyone apply for a digital TDC?

A1: Yes, most digital TDC providers offer their services to a wide range of consumers. However, eligibility criteria may vary, and users may need to fulfill certain requirements.

Q2: Are digital TDCs secure?

A2: Yes, digital TDCs employ robust security measures, utilizing encryption and biometric authentication to protect users’ financial information. As with any form of online banking, users must also take personal precautions, such as choosing strong passwords and avoiding sharing sensitive information.

Q3: Can I use a digital TDC for online shopping?

A3: Absolutely! Digital TDCs are primarily used for online transactions. They provide users with unique card details for each purchase, adding an extra layer of security.

Q4: Can I use a digital TDC for physical transactions?

A4: Some digital TDC providers offer physical cards that can be used for in-store purchases. These cards are linked to the user’s digital TDC account and function similarly to traditional cards.

Heading 5: The Future of Digital TDCs

As fintech continues to evolve and gain momentum, the future of digital TDCs looks promising. With ongoing advancements in technology, we can anticipate more secure and efficient payment solutions. As we move forward, digital TDCs are likely to become even more integrated into our daily lives, simplifying our financial transactions further.

In conclusion, the rise of fintech has paved the way for exciting developments in the financial industry. Digital TDCs have emerged as a convenient and secure alternative to traditional payment methods. With the ability to manage finances at your fingertips, the digital world of TDCs offers an enhanced financial experience. So, why not embrace the future of finance and explore the possibilities of digital TDCs today?